The National Trend: Rising Rents and Consumer Expectations Set the Stage for Vertical Warehouse Development

The growth of e-commerce and rising consumer expectations for rapid home delivery of retail purchases is fueling record demand for industrial space across the U.S. Over the past five years, the national vacancy rate declined from 7.1% to 5.1%, while the average asking rent rose by 33% to an all-time high of $7.37 per square foot. Developers have rushed new construction in order to meet demand, but they are stymied by land constraints, particularly in coastal markets. Centrally located infill sites that can facilitate last-mile logistics are both sought-after by tenants and in very short supply. The resulting unmet demand is setting the stage for rethinking traditional warehouse design for an urban setting.

Multistory industrial buildings are not an entirely new concept; urban warehouses utilizing lifts to reach upper levels was the old way of efficiently storing goods prior to the single-story suburban warehouses that became ubiquitous during the second half of the 20th century. However, modern multistory industrial design, which already is common in parts of Asia and Europe, distinguishes itself by offering drive-up loading facilities on upper floors so that it can provide the full functionality of a single-story distribution center. In the United States, straight truck ramps can be used to accommodate full size tractor-trailers, unlike the spiral ramps seen in other parts of the world where trucks tend to be smaller.

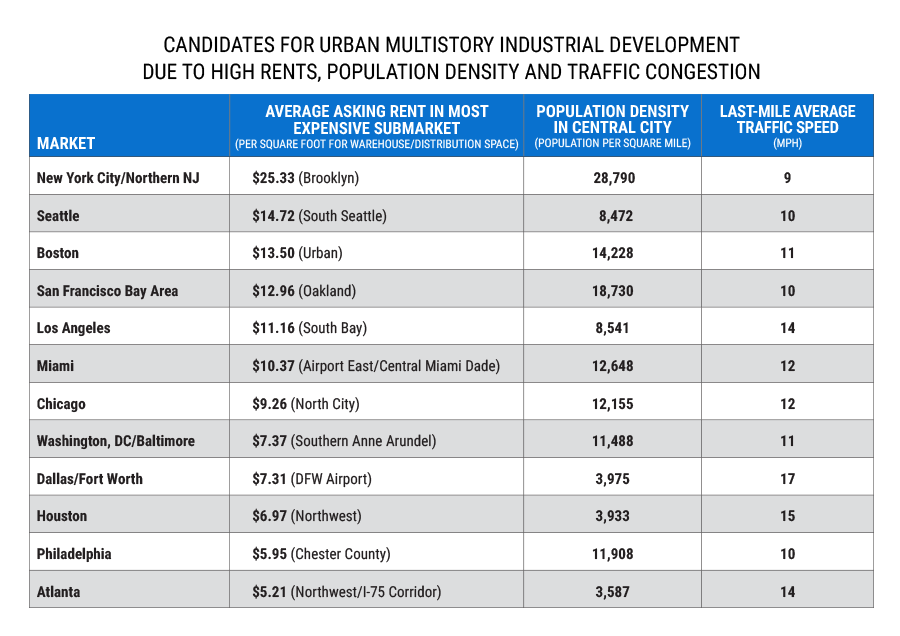

The first modern multistory industrial development constructed in the U.S. was the Prologis Georgetown Crossroads project in South Seattle. The three-story, 590,000-square-foot project was completed last year; the first floor has leased to Home Depot while the top two stories so far remain unleased. Two multistory warehouse projects are set to break ground this year in New York City, while additional projects are proposed in both New York and San Francisco. Densely populated and developed metropolitan areas that have severe traffic congestion and limited availability of modern inventory—and centrally located submarkets where rents are high enough to compensate developers for their higher costs—are potential candidates for multistory industrial development. Based on these factors, Boston, Miami and Los Angeles may be the next markets to see this new product type emerge; see the adjacent table for other candidates. Amazon reportedly is prototyping a different model of vertical industrial development in several markets, including in Southern California, Atlanta, Milwaukee, Raleigh and Minneapolis. These single-tenant facilities would stand 80 feet tall and are expected to make use of mezzanines and robotics to move product between levels.

Source: Newmark Research

Featured Market: New York City/Northern New Jersey

Vacancy for existing warehouse and distribution space is exceptionally low in the New York area, ranging from 3.6% to 4.8% in the New York City boroughs and Long Island and averaging 4.8% in neighboring Northern New Jersey. Land sites for new development also are becoming harder to secure throughout the region, especially in gentrifying urban areas like Brooklyn, as former industrial sites are taken for residential redevelopment. According to statistics from INRIX, the average speed of traffic traveling the last-mile in New York City is the slowest in the nation at a mere nine miles per hour—which makes being centrally located essential for compressed delivery time windows.

The forthcoming 640 Columbia Street in Brooklyn will rise three stories and offer a total of 336,000 square feet for lease. The development, which broke ground earlier this year, will feature a truck ramp providing direct access to the second story and an elevator to reach the top floor. Set to begin construction later this summer, 2505 Bruckner Boulevard in the Bronx is a 700,000-square-foot, two-story warehouse offering loading on two levels; it too is a speculative development. At least five other similar projects have been proposed throughout Brooklyn, Queens and the Bronx. Looking ahead, rising rents in Staten Island, as well as in the densely developed parts of New Jersey such as the Hudson Waterfront and Meadowlands, will make these locations future candidates for multistory industrial development.

What Are the Implications for Our Clients?

Urban multistory industrial product is untested, both in terms of leasing velocity and in value in the capital markets; potential investors may be interested but cautious. How to underwrite the lease-up time and what rents to pencil remains challenging. In theory, the buildings have the same functionality as a single-story distribution center, but completed transactions will be necessary to substantiate this. In addition, the exit and residual value of the investment also is unproven, while the availability and cost of financing is unknown. The first movers in this new product type likely will be rewarded with higher yields, which are all but certain to compress if and when the product type is accepted by the market. Occupiers who are open to the multistory design can benefit from the ability to lease modern logistics space in densely populated areas that previously would not have existed. Distributors who occupy the first wave of urban multistory developments may gain an advantage over their competitors; their warehouse design may help them to deliver retail merchandise to consumers in increasingly narrow time frames.