The National Trend: Traffic is an Important Consideration in Office Tenants’ Decision Calculus

Americans lost an average of 97 hours to roadway congestion in 2018, time valued at a cost of nearly $87 billion, or an average of $1,348 per driver. Companies feel the pain as well, since 41% of employees have left a job due to long commutes, while 60% expect their employers to help lessen their transportation woes. A tight labor market, in which skilled workers have options, reinforces the challenge a long commute presents not only to the employee but to the employer as well.

Where a company decides to establish an office location is contingent on multiple factors, including existing employee commute times, access to a skilled labor pool, parking availability, access to public transit, proximity to existing clients, surrounding amenities, the ability to expand, general real estate costs, taxes, proximity to airports and hotels, and where senior executives live. For larger companies, there is also the question of which business units a future office location will house; back office functions do not drive demand for premier locations compared to more client-facing departments.

While all of these factors shape the dynamics of individual office markets, traffic is an important consideration in office tenants’ decision calculus. Traffic concerns play an especially outsized role in densely populated markets.

Featured Market: Los Angeles

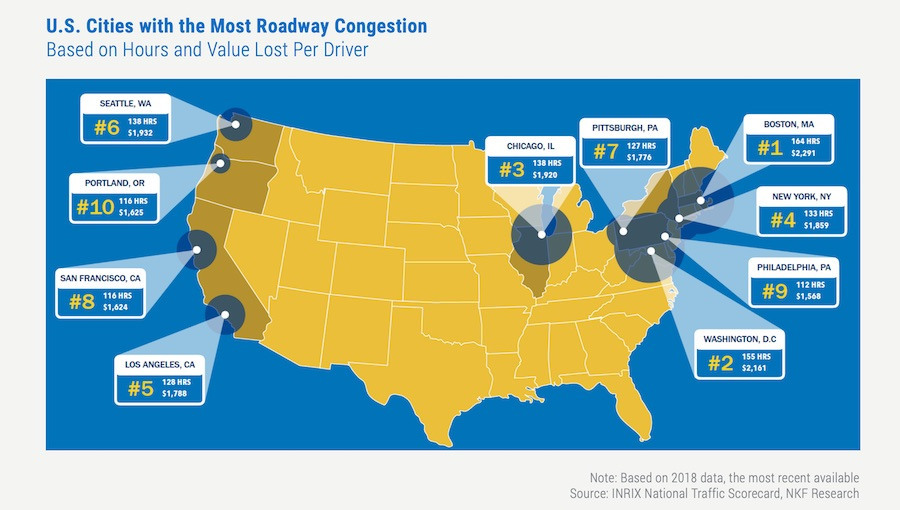

Los Angeles ranks fifth in the nation in roadway congestion, as shown in the below graphic. It also has the third-largest tech ecosystem in the world after San Francisco and New York, which continues to evolve as the largest tech firms (the so-called FAANG companies) grow their footprints to develop original content and programming for distribution on their networks. Tech and Hollywood are mixing, and Santa Monica is the region’s epicenter, with its easy walkability, plentiful amenities and beach lifestyle as draws. The city also has the metro area’s priciest office rents and severe traffic challenges; Santa Monica is west of I-405, where traffic moves an average of 27.5 to 28.8 mph, based on whether traveling north or south, during the evening commute. Additionally, 8.4 million tourists visit the city each year, adding to the local bottleneck.

Some entertainment companies want out of Santa Monica since there are limited windows — not before 9:00 AM and not after 3:00 PM — for agents and talent to visit its offices. This has prompted some tenants, including HBO and Amazon, to relocate to Culver City to the east. Situated along I-10, where evening traffic moves 31.1 to 53.7 mph, depending on whether traveling east or west, Culver City underwent a construction boom after the opening of the Expo Line, a commuter rail line connecting it to Santa Monica and Downtown Los Angeles, in May 2016. At the time, Culver City’s average Class A asking rent was 36.3% lower than Santa Monica’s, while vacancies were comparable in both markets.

Culver City’s tenancy growth since has been pronounced with Amazon set to occupy 600,000 square feet and HBO committing to 254,000 square feet. This is in addition to new leases of more than 100,000 square feet each for WeWork, Bytedance and a major tech occupier. Developers have taken notice, and the city led the metro area in underway ground-up construction activity by year-end 2019.

Culver City is five miles east of Santa Monica, suggesting the new commute times of most of HBO and Amazon’s existing employees will not be as severe if the companies had relocated, say, 10 or 20 miles away. Additionally, one can assume most junior- to mid-level employees live further inland, where apartment rents are less than coastal locations. The city also benefits from its more interior and central location.

What Are the Implications for Our Clients?

What are some broadly applicable lessons from the office location decisions being made in Los Angeles? Reducing employee commute times, or at least the stress of a long commute, favors retention and enhances productivity. To that end, an office location near rail transit is an option, as is offering employees flexible work hours or the ability to work remotely. Some companies even offer transportation services from the employees’ doorsteps or from set pickup locations to the office. For instance, Google has Northern California bus services, in which most employees choose to work during their commute. It is a value-add for both parties: Employees reduce their transit costs, while Google enhances its employee productivity, improves its retention and lowers parking requirements at its offices.

The coworking model is another antidote to traffic since many executives use such space as satellite or primary offices to avoid gridlocked freeways. As larger coworking providers generally seek affluent market areas and have multiple locations throughout major metros, enterprise membership counts will increase over time.

For investors and developers, multiple factors come into play when deciding where to place capital. Determining where up-and-coming corridors will emerge is one of them, and future rail transit is a strong indicator as it opens a market to a greater labor pool, enhances its visibility, and presents an alternative to busy freeways. Markets near established corridors stand to benefit the most, especially those in the pathway of tenant migration away from higher cost, heavily trafficked areas.

Research

Sources: City of Santa Monica, INRIX, Newmark Research, PayChex, Robert Half, TransDec, USC Annenberg School for Journalism