The National Trend: Financial and Technology Companies’ Job Growth is Driving Demand for Office Space in Emerging U.S. Markets

Many primary and secondary U.S. office markets are experiencing growth in leasing activity, rental rates, and demand for space. However, several secondary (or emerging) markets stand out due to their performance during the current cycle. These emerging office markets have seen relatively high levels of new product delivered while maintaining strong positive net absorption, and they have become an attractive alternative to gateway markets for both investors and large tenants. These emerging U.S. office markets include but are not limited to: Austin, TX; Charlotte, NC; Nashville, TN; Portland, OR; Raleigh-Durham, NC; and Salt Lake City, UT. Other markets, such as Pittsburgh, PA, do not quite match the ones above in terms of recent absorption and rent growth but will be watched closely by investors seeking increased yield due to their emerging high-tech industries like robotics or artificial intelligence.

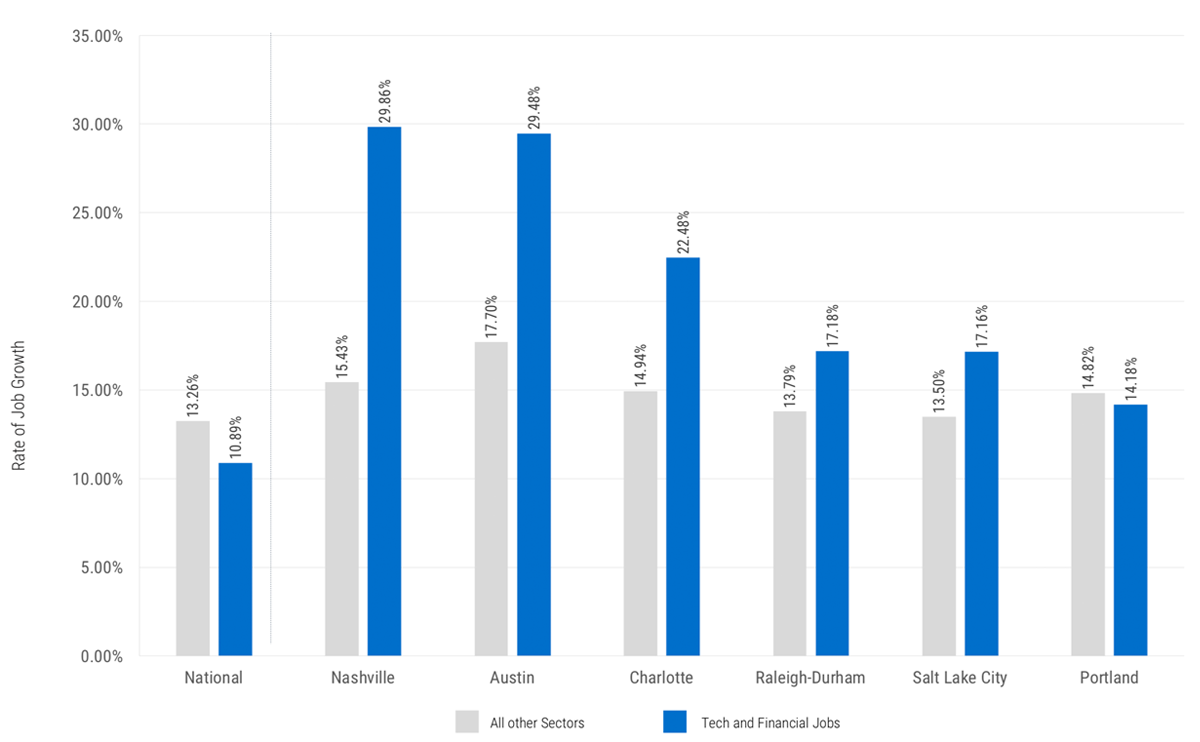

A lower cost of doing business, a talented and educated workforce, modern inventory, and state and local tax incentives are among the drivers fueling office space demand in the country’s emerging markets. In most of these markets, technology and financial job growth outpaced the growth of all other industries. Job growth in these two sectors exceeded 15% from 2014-2018 in Austin, Charlotte, Nashville, Raleigh-Durham, and Salt Lake City; in fact, in Austin and Nashville, tech and financial services job growth was nearly double that of all other sectors combined for the specified time frame. (See the adjacent graph.) These emerging markets have a high concentration of graduates with degrees in technology and finance, and companies can recruit qualified employees quickly, thanks in part to a lower cost of living and vibrant local culture. Companies also are able to expand operations in these emerging markets at a reduced cost. The average rental rate in the top six primary U.S. office markets is $51.91 per square foot per year, full service. This compares with $28.18 per square foot per year, full service, in these six emerging markets. Some of the companies that are seizing upon this comparative advantage by expanding in emerging markets include Amazon, AvidXchange, Facebook, Global Payments, Goldman Sachs, Google, Visa, and Wells Fargo.png

Companies looking for space in these markets are largely seeking Class A space, creating an impetus for new Class A development, or renovations to well-located Class B product. It has become especially difficult to find large contiguous spaces in Class A buildings, so expanding tenants frequently must wait for new development. Coworking operators are increasing their presence in emerging markets, in part to meet the immediate needs of these tenants. For example, the growth rate of coworking space from 2016 to 2018 was 172% in Austin and 142% in Salt Lake City—well ahead of the 95% growth rate nationally during that period.

Featured Market: Salt Lake City

The demand for office space in Salt Lake City has largely been focused on the suburbs, and particularly in the Tech Corridor, an area along I-15 straddling southern Salt Lake County and northern Utah County, which is part of the larger Silicon Slopes area. The cheaper cost of land and the presence of technology firms are a couple of factors driving this interest in suburban office demand.

Microsoft’s decision to expand in Utah in 2009, followed by Adobe constructing a 280,000-square-foot campus in 2012, grabbed national attention and cemented Utah as a destination for companies looking to move and/or expand. Since 2010, 78 buildings totaling 8.7 million square feet delivered within the Tech Corridor, with another 2.3 million square feet in 15 buildings currently under construction. Companies such as Adobe, eBay, Thumbtack, Podium, and Pluralsight have moved in or are expanding within the region. Even with all the added inventory, the direct vacancy rate for the Tech Corridor remains low, at 3.6%. Along with a highly talented workforce, the Salt Lake City market’s average asking rental rate of $22.21 per square foot, full service, is well below that of most primary markets and is the lowest of the emerging market cohort.

What Are the Implications for Our Clients?

Emerging office markets will continue to be an intriguing alternative to primary markets for both tenants and investors, particularly at a time when so many firms are seeking to locate in markets that appeal to millennial workers, as these metro areas do. Institutional investors certainly have taken notice of these emerging office markets—many offer a higher yield at lower sale prices relative to primary markets. Tenants looking for large blocks of Class A space will need to start their search early, as much of the newly-developed office product is already committed by the time it delivers. Developers and investors who are looking to attract and retain top professional services tenants will need to own assets with strong amenities packages and be willing to upgrade office suites as needed to compete effectively.

Sources: Bureau of Labor Statistics, Newmark Research