This piece highlights the recent increase in suburban office investment in Greater Boston, and identifies several factors that have been critical to the attraction of institutional capital among suburban office assets.

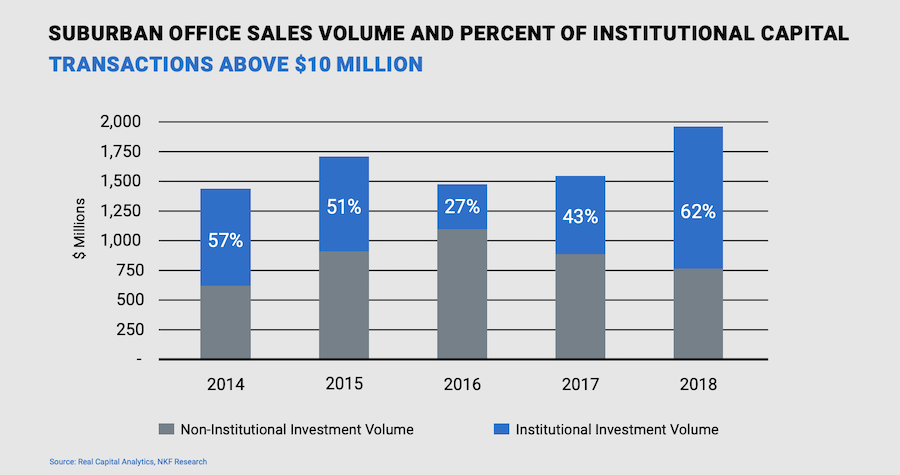

Greater Boston’s office investment market has witnessed a spike in activity in recent quarters following a lull dating back to mid-2017. Suburban office sales volume reached a five-year high in 2018 as investors have snapped up a string of assets along the Route 128 corridor and in the urban fringe.

Of particular note, there has been a greater influx of institutional capital in the suburbs, which has exceeded more than 60% of total suburban investment volume in 2018. This piece elaborates on several factors that have been critical to the attraction of institutional capital among suburban office assets.