October 2018

Transitions in the U.S. Hospitality Sector

By Amy Binstein

The National Trend: Brands Seek to Differentiate Themselves in an Appeal to Millennials

Market conditions in the U.S. hospitality sector are greatly affected by the strength of the national economy. As the economy continues its tenth consecutive year of expansion, business and leisure travel is increasing and bolstering hotel market metrics. During the past 12 months, hotel occupancy was up 1.1%, the average daily rate (ADR) increased 2.4%, and revenue per available room (RevPAR) rose by 3.4%. There has been a 2.0% increase in hotel supply in the past 12 months in order to accommodate the increase in guests, but the type of demand that the market is experiencing is changing. Hotel brands are seeking to appeal to millennials who are increasingly traveling on their own for both business and pleasure.

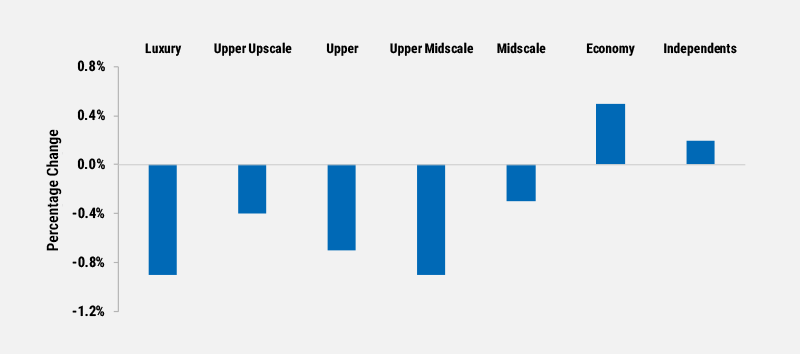

Attempts to capture this burgeoning target market have resulted in new brands popping up and established brands realigning their strategies. Instructively, the only two types of hotels chains that experienced increases in occupancy on a month-over-the-year basis—that is, when comparing July 2017 performance to July 2018 performance—were economy and independent hotels, as shown in the adjacent graph. Independent hotels include boutique and soft-brand collections, which focus on curated experiences—a feature millennial travelers tend to value. These hotels often are closely affiliated with the local community and provide unique amenities to guests. New brands from established chains—from Marriott’s Moxy and Aloft to Hilton’s Canopy—have debuted with a goal of attracting younger travelers. Meanwhile, economy hotels are in demand by consumers who have seen their wages struggle to keep up with inflation.

U.S. HOTEL CHAINS BY CATEGORY

Change in OccupancyJuly 2017 vs. July 2018

Source: STR Global, Newmark Research, October 2018

Featured Market: Chicago’s Hotel Landscape is Evolving

A prime example of the ongoing transition in the U.S. hotel market is in Chicago, where budget hotel brand Red Roof is opening its first soft-brand, the Red Collection. The debut location for this new flag is just one block from Chicago’s famed Magnificent Mile. The hotel, The St. Clair, will serve as the brand’s foray into the upper-midscale, city-center hotel market. The new brand also will reflect the local culture in which its properties are located by featuring local art. The brand’s research showed that its target customer is not looking for a trendy or hip hotel but instead “modern and accessible lodging with enhanced amenities in the heart of cities.” This new flag, and its competing soft-brand hotels, allow travelers to enjoy the same benefits the brands have always offered in the economy segment of the market but with a more youthful and upscale feel.

In addition to new brand concepts, Chicago is seeing a new type of hotel opening. This spring, Found Chicago opened in the River North neighborhood. The building was once home to single occupancy apartments but has been fully renovated and transformed into a 60-room hotel. The hotel calls itself a “limited-service” hotel and rates are as low as $24 per night for a bunk bed in a shared room. Shared rooms offer two bunk beds, in-room lockers and a bathroom. Private rooms also are available. The hotel also has plans to open a restaurant by The h.wood Group, a Los Angeles-based lifestyle company. In addition to the restaurant, a bar and lobby-level coffee shop will be featured. While this is the Found brand’s first location, plans include locations in Boston, San Francisco and Los Angeles.

What Are the Implications for Our Clients?

As the economy continues on its sturdy trajectory, and travel—both personal and business—continue to accelerate, the hotel industry will continue to evolve along with the changing tastes of its guests. According to STR, in 2018 the U.S. hotel industry will experience a 0.6% increase in occupancy compared with 2017, while RevPAR will grow by 3.2%. Updated offerings will be needed to drive further revenue growth. This impetus will create opportunities for investors. Since many of the new formats are aimed at budget-conscious travelers, investors might want to explore luxury investment opportunities—there is limited new luxury product being developed even as overall economic conditions suggest room nights will rise, and ADR is growing fastest in this segment of the market. Office and retail developers may wish to target these new hotel developments as potential neighbors, with adjacency a particular convenience for tenant types that do out-of-town business or host conferences.