The Chancellor delivered her second Autumn Budget yesterday and as expected, there were a number of announcements related to business rates. To coincide with the delivery of her speech, the Valuation Office Agency has also now published the draft rateable values which will take effect from 1 April 2026 when the new rating list will go live. This means that businesses can now accurately budget for their rate liabilities next year.

Budget Headlines

- Multipliers: The new multipliers for England have been rolled out, including the additional multipliers legislated for earlier in the year.

- Transitional Relief: A transition scheme has been announced to cap increases for those experiencing the largest increases at the revaluation.

- Support for Small Businesses: A Supporting Small Business Scheme (SSB relief) has been introduced for properties losing some or all of their small business relief or rural rate relief, and Small Business Rates Relief (SBRR) has been extended, allowing businesses taking a second property to remain eligible for relief on their first property for three years rather than one year.

- EV Charging: 100% relief for a ten-year period has been announced for electric vehicle charging points where separately assessed and for EV-only forecourts (EVCP Relief).

- Transforming Business Rates: Pressing ahead with the reform proposals highlighted in the initial responses to the Transforming Business Rates white paper, a Business Rates and Investment Call for Evidence has been published with responses due by 18 February 2026.

New Multipliers

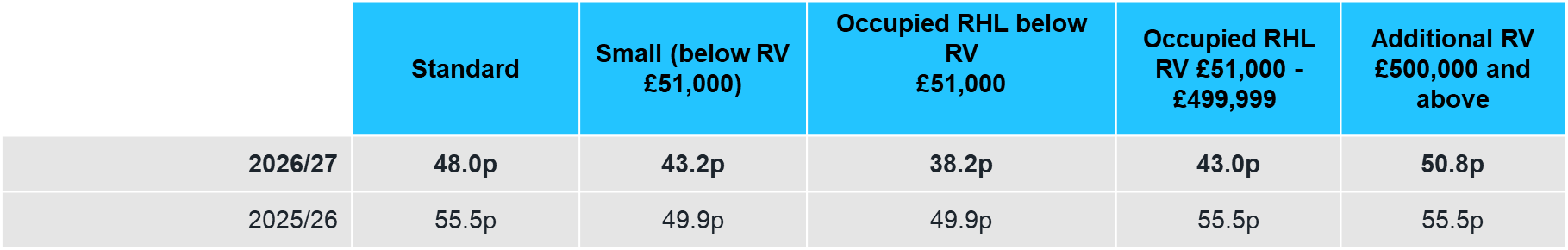

For the first time, the number of multipliers in England has increased from two to five. The Chancellor has confirmed there will be two lower multipliers for qualifying retail, hospitality, and leisure properties with a rateable value of below £500,000 and a higher multiplier for all properties with a rateable value of £500,000 or more. These are in addition to the standard and small multipliers which have been in place over recent years.

The Government has confirmed that the discounted retail hospitality and leisure (RHL) multipliers for qualifying properties with a rateable value below £500,000 will be set at 5p below the standard and small multipliers, with the additional multipliers for properties with a rateable value of £500,000 or more being set at 2.8p above the standard multiplier.

In our pre-budget rating update, we explained the calculations the Government has to make to arrive at the new multipliers for a revaluation year.

The full range of multipliers in England for the 2026/27 rate year will now be as follows:

*Note there will be a 1p supplement to the above multipliers for one year for properties who do not benefit from the transitional relief scheme or the supporting small business scheme.

**Note that the discounted multipliers for qualifying RHL properties only apply when occupied. Vacant RHL properties will revert to the standard or small multiplier once the initial 3-month period of 100% empty rate relief comes to an end.

Details regarding qualification criteria for RHL properties can be found in the guidance issued to Local Authorities.

*** Also note these multipliers do not include the Greater London Cross Rail Supplement of 2p or the City of London multipliers.

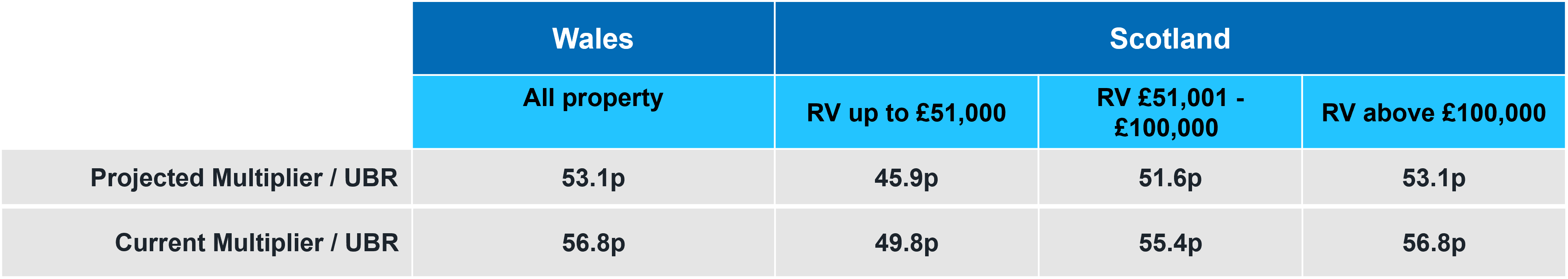

Due to the late timing of the budget in England, we are unlikely to know the actual multipliers in Wales and Scotland until their own budget statements which are due in January. Scotland’s is scheduled for 13 January, while Wales has yet to confirm a date. We are therefore continuing to base our forecast estimated liabilities on the assumptions outlined below:

The Welsh Government has confirmed its intention to introduce a lower multiplier which will only apply to retail properties with a rateable value under £51,000. This will be funded by applying a higher multiplier to all properties with a rateable value of £100,000 and above. We are awaiting further details on these proposals.

Transitional Relief

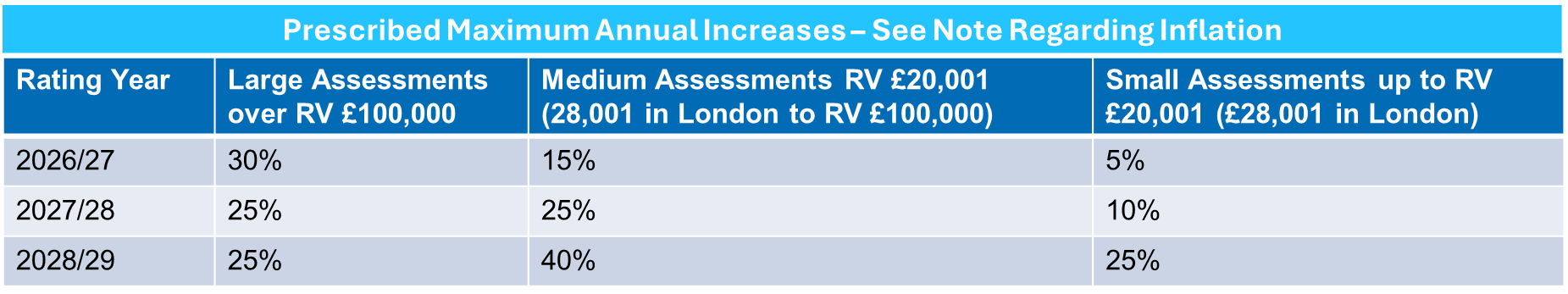

In its Interim Report on transforming business rates, the Government confirmed that a transitional relief package would be introduced for the 2026 revaluation to support businesses facing significant increases in rateable value.

The Chancellor has now provided details of the scheme, which will offer welcome relief to those most affected.

Under the scheme, the increases will be capped on the following basis:

*Inflation: For England the increases for 2026/27 reflect inflation. For 2027/28 and 2028/29 adjustments are required to reflect inflation.

New regulations will be required to cover the calculation of liabilities from 2026 in line with the new transitional schemes. A guidance note has been published to local authorities providing details of how the transitional relief, transitional relief supplement, and supporting small business scheme will operate and this will be incorporated into our rate liability estimates going forward.

2026 Draft List Rateable Values

The VOA have issued the draft 2026 Rating List for England and Wales ahead of the 2026 Rating List commencing on 1 April 2026. These figures cannot yet be formally challenged through the Check Challenge Appeal process. However, any clear errors or discrepancies can still be raised with the VOA.

For England and Wales, the total rateable value under the draft list is £84.4bn - an increase from the 2023 Rating List which currently stands at £70.8bn. This reflects an increase of 19.2% with values for properties in England increasing by 19.4% and those in Wales by 15.2%. Additionally, the Central Rating List, covering utilities, telecoms, etc has seen an increase to £5.3bn in draft rateable values, reflecting a 34.4% increase compared to the 2023 Rating List.

The draft list in Scotland will be published on 30 November, and we will update further on local changes once the data is available.

We will continue to keep you updated on any further changes as we approach April 2026. In the meantime, our team is here to answer any of your questions.