With the Autumn Budget in England set for 26 November and the revaluation for Non-Domestic properties to take effect from 1 April 2026 we take this opportunity to review the latest updates from government and look ahead to the revaluation and the impact that this will have on businesses and their rate liabilities going forward.

Transforming Business Rates – Interim Report

In September, the Government finally published their interim report following initial responses to the Transforming Business Rates white paper issued at the same time as the Autumn Statement 2024.

The interim report identifies a number of priority areas from the written responses and discussions at roundtable events as follows:

- “Slab” to “Slice” Reform: The Government is exploring a shift from a “slab” to a “slice” approach to reduce cliff edges in the business rates system, where changes in multiplier currently apply to the whole of a property’s rateable value. This issue has become more pronounced as the gap between small and standard multipliers has widened and will intensify with the introduction of new additional multipliers next year.

- Enhancing Small Business Rates Relief (SBRR): Responses highlighted that SBRR criteria haven’t changed in years, with full relief for qualifying occupiers of single properties under RV £12,000 and tapered relief up to RV£15,000. The Government is concerned that losing this relief when taking on a second property is discouraging growth among small businesses.

- Enhancing Improvement Relief: The improvement relief, introduced for works completed after 1 April 2024, has provided limited data so far, but concerns have been raised about overly restrictive criteria. To better support investment, stakeholders argue the 12-month relief period should be extended to at least three years and made available to all building owners and occupiers, regardless of occupation status. The Government plans to review this once more complete data becomes available.

- Exploring concerns over the Receipts and Expenditure valuation methodology: Ratepayers in sectors where the VOA uses the receipts and expenditure method for valuations have raised concerns about uncertainty and its impact on investment. This issue is expected to be reviewed ahead of the 2029 revaluation.

- Exploring the possible benefits of Shortening the Antecedent Valuation Date (AVD): Ratepayers have long called for a shorter gap between the valuation date and revaluation, currently set at two years, which can lead to outdated rateable values. Moving to a one-year gap, as adopted in Scotland since the 2023 Revaluation, would better reflect market conditions and is now seen as achievable across the UK.

- Using the merger of the VOA with HMRC to pursue administrative change that helps ratepayers: The paper outlines that reintegrating the VOA into HMRC should enable faster delivery of changes. It’s hoped this will also improve data sharing across departments, reducing the burden on ratepayers to submit the same information multiple times.

Bearing in mind that the interim report was only published in September, there is very little time to carry out meaningful engagement before the Budget. Our expectation is that these will be areas for yet more consultation in the future rather than being addressed now. The only decision actually reached in the interim report was to keep with revaluations on a three yearly cycle rather than to consider whether they should be held more frequently. We are also disappointed that the Government has not committed to a more thorough review of the empty rate rules where many ratepayers have expressed that the current position of three months at 100% empty relief form most ratepayers (and six months for qualifying industrial properties) is not sufficient to support investment in empty properties.

2026 Revaluation

From 1 April 2026, all non-domestic properties in the UK will be subject to new rateable values based on the outcome of the 2026 Rating Revaluation undertaken by the VOA in England and Wales, and the Assessors in Scotland. For England and Wales, the draft 2026 Rating List can be published at any time up to 31 December 2025, but we are anticipating publication to coincide with the Chancellors Autumn Budget on 26 November. In Scotland, the Draft Roll is set to be published on 30 November. Multipliers in England for 2026/27 will be confirmed at the budget and for Scotland and Wales, these are expected to follow in January.

In advance of the revaluation, we have undertaken our own shadow revaluation exercise for all properties in England, Wales and Scotland assigning individual values based on the movement in rental value based on property type and location. For England and Wales, the antecedent valuation date (AVD) is 1 April 2024 compared to the AVD for the current 2023 Revaluation of 1 April 2021. In Scotland the valuation date is 1 April 2025 compared to 1 April 2022 for the 2023 Revaluation.

Calculation of Multipliers at Revaluation

The Valuation Office Agency provided the draft rating list to the government at the start of the Summer and since then they will have been analysing the numbers to be able to confirm the multipliers at the Autumn Budget. In a non-revaluation year, the increase to the multiplier is limited by the CPI inflation level at the preceding September. During the Covid-19 pandemic, both the standard and small multipliers in England were frozen. Since 2023/24, the standard multiplier applicable to properties with a rateable of RV £51,000 or more has increased in line with the inflation figures whilst the small multiplier has remained frozen. Scotland has also kept their lower multiplier frozen whilst in Wales the single multiplier has also risen year on year. At the revaluation, the increase in the total tax take from business rates is still capped by inflation but the calculation is further complicated by the change in the total rateable value. If the total rateable value resulting from the revaluation increases by more than inflation, then the multipliers should fall.

This year, the position in England is significantly complicated by the additional multipliers as provided for in the Non-Domestic Rating (Multipliers and Private Schools) Act 2025. The Act provides for two new discounted multipliers for properties in the retail, hospitality and leisure (RHL) sectors with rateable values below £500,000 and an unlimited number of additional multipliers for properties with a rateable value of RV £500,000 or more. The lower multipliers are capped at a maximum discount of 20p from the small multiplier for the year to which they relate whilst the higher multiplier is capped at a maximum 10p increase from the standard multiplier. Whilst there is therefore a degree of flexibility within the legislation, the Government has indicated that for 2026/27, their intention is to apply one of the discounted multipliers to RHL properties with an RV of below £51,000 and the other for RHL properties with a rateable value of between £51,000 and £499.999.

Government policy to date has been for a single additional multiplier for properties with a rateable value of £500,000 or more and that the intention is that the higher multiplier will offset the cost of the lower multipliers. The higher multiplier is expected to offset the cost of these discounts. The Regulations covering the definition of qualifying RHL properties from April 2026 have been published yesterday afternoon The Non-Domestic Rating (Definition of Qualifying Retail, Hospitality or Leisure Hereditament) Regulations 2025. The accompanying Local Authority Guidance states that the regulations are intended to broadly reflect the scope of the current RHL scheme however it also explains that local authorities will have to administer the lower multipliers in line with the legislation and will not have the same degree of discretion as for the current relief scheme. We are reviewing the regulations and guidance and can assist with queries on individual properties. For the purposes of forecasting our modelling has assumed criteria similar to the current RHL scheme.

Forecast Movement in Rateable Value Between 2023 and 2026 Rating Lists

Our start point for forecasting the movement in rateable value between the rating list is to consider the movement in rental value between the valuation dates and as a base for this exercise we have referenced the MSCI UK quarterly property index which tracks the performance of over 6,200 property investments with a total capital value of £122.1 bn.

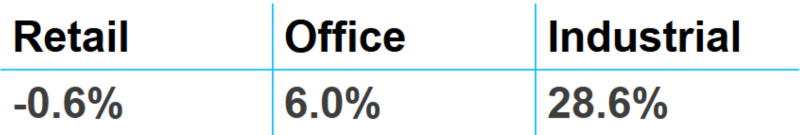

Rental movement across the main “bulk” class property types, i.e., retail, offices, and industrial, in the UK using this data shows the following:

Source MSCI

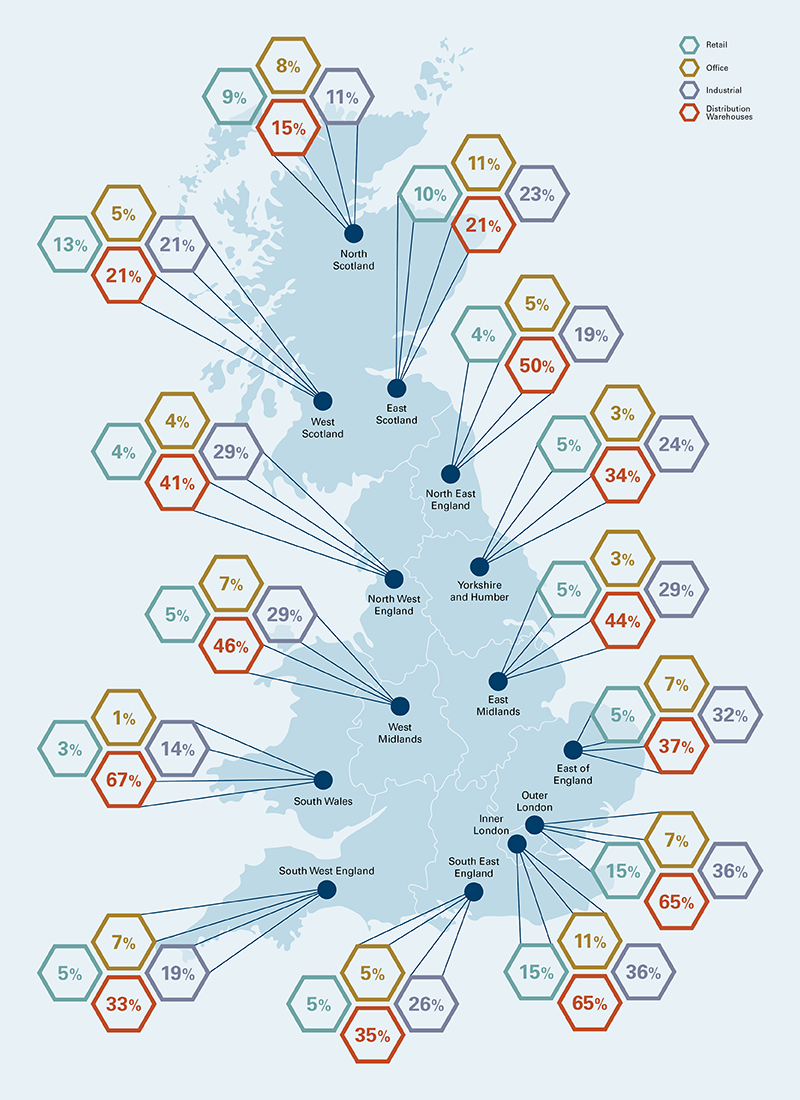

At Newmark, we have enhanced this data with our own specialist sector knowledge. Using data from our Prime Logistics and Multi Let research papers, and intelligence from our team of experts, we have considered rateable value movement across the different sectors and regions as detailed on the map below.

Source: MSCI NEWMARK

Impact of the Revaluation on Rate Liabilities from 2026

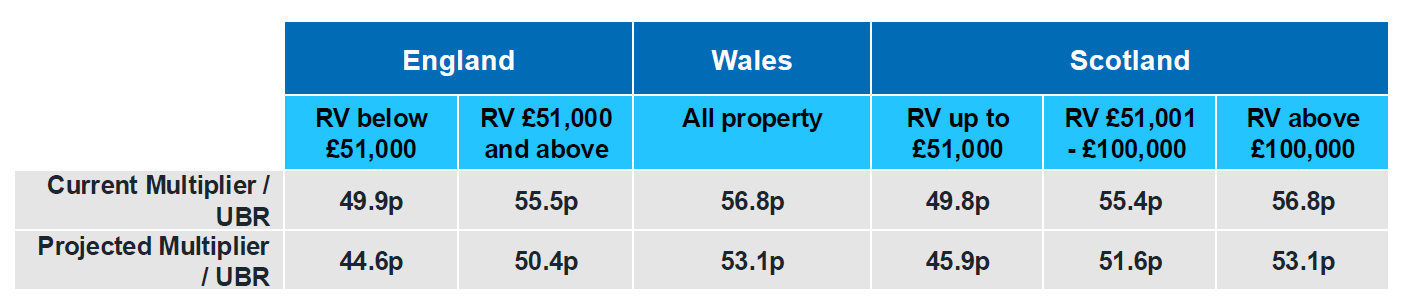

Our findings are that, as a result of rental growth across many sectors and regions, the total rateable value will increase at the Revaluation, which will allow the Chancellor to reduce the basic multipliers. Based on our analysis, we believe that there is a possibility that the standard multiplier in England could fall from 55.5p to 50.4p and, assuming that the differential between the standard and small multipliers remains as for the current rate year, we could see the small multiplier in England falling from 49.9p to 44.6p.

Running similar analyses for Wales would result in a fall in the multiplier from 56.8p to 53.1p. In Scotland, assuming that the three multipliers are retained, we would expect a fall from 49.8p to 45.9 p for the basic multiplier, from 55.4p to 51.6 for the intermediate and from 56.8p to 53.1p for the small.

This would be positive news for some ratepayers – especially where their rateable value is expected to increase by less than 10%, but the position with the three additional multipliers in England makes forecasting very difficult.

More Complication in England - The Additional Multipliers

With the new legislation providing for at least five multipliers in England, rate demands from 2026 onwards are going to become even more difficult to understand.

If the full uplift of 10p allowed by the legislation is applied to the higher multiplier, then this could – for the first time – result in a multiplier for some businesses in excess of 60p. This is not a position that would assist the Government’s intention as set out in the transforming business rates paper to “incentivise investment and growth”. In discussions since the Act was passed, Government representatives have emphasised that the maximum levels within the legislation are “guardrails” and that ratepayers should not expect the adjustments to be at these levels. It is very difficult to predict where the additional multipliers may land as this will largely be a political decision. However, if the intention is to self-fund the scheme within the system, then there will be a limit as to how generous the Chancellor can be to the retail, hospitality and leisure sectors. We have modelled some scenarios based on assumptions as to qualification based on the current relief schemes and have estimated that, if a 10p discount was applied to the smaller RHL properties with a rateable value below £51,000 and a 5p discount to those with rateable values of £51,000 to £499,999, then a higher multiplier of 5.4p could be required. This would result in a highest multiplier of 55.8p, which is only marginally higher than the current standard multiplier and may be a more palatable message to larger businesses.

The Welsh government has indicated in their draft budget papers that they are also planning to introduce a lower multiplier for small to medium sized businesses. They consulted on options for this earlier in the year, but we await more detail.

Transitional Relief

In the Interim Report, the Government confirms that a transitional relief package will be delivered for the 2026 revaluation to support those businesses seeing large increases in their rateable values. This is a positive step, but businesses will have to wait until the Autumn Budget to understand whether the relief will be material. At the last revaluation, larger businesses still faced increases of over 30% in England and if the calculation method remains unchanged, some businesses will face substantially higher increases as a result of the impact of the new multipliers. Ratepayers in Scotland and Wales will have to wait a little longer for certainty for 2026 – the Budget in Scotland will not take place until 13 January 2026 and 20 January in Wales.

We are continuing to lobby the Government to announce as much as possible in advance of the Autumn Budget and yesterday afternoon guidance to Local Authorities regarding the RHL qualification has been released. However, it is clear that ratepayers will have to be patient on the multipliers, transitional scheme, and draft rateable values.

Please watch this space for further updates in advance of and following on from 26th November. In the meantime, we are here to assist with any property-related inquiries and keep you informed on business rates developments across the UK.