The National Trend: “Star Submarkets” Feature Common Denominators

The first quarter of 2021 marked a year since the office sector was

upended due to COVID-19, a year in which each of the 56 U.S. office

markets tracked by Newmark Research realized an increase in vacancy on

the heels of economic turbulence and persistent remote-work strategies.

Most of these metro areas endured a deterioration in fundamentals

throughout the region, but not all: 12 metro area markets reported “star

submarkets” that typically exhibited more favorable vacancy trends,

lower increases in sublease space, and stronger rent performance as

compared to their peer submarkets. In some cases, those star submarkets

did not just remain stable but flourished despite the considerable

headwinds generated by the pandemic. Analysis of these disparate pockets

of office properties revealed certain commonalities that, while not

panaceas for all of the risks and challenges facing the office sector as

a whole, nonetheless emerged as key stabilizers. Those core

commonalities of “star submarkets” include:

- Growing demand from life sciences firms.

- Being anchored by educational and health institutions, or mature tech firms such as Facebook, Apple, Amazon, Netflix and Google (FAANG).

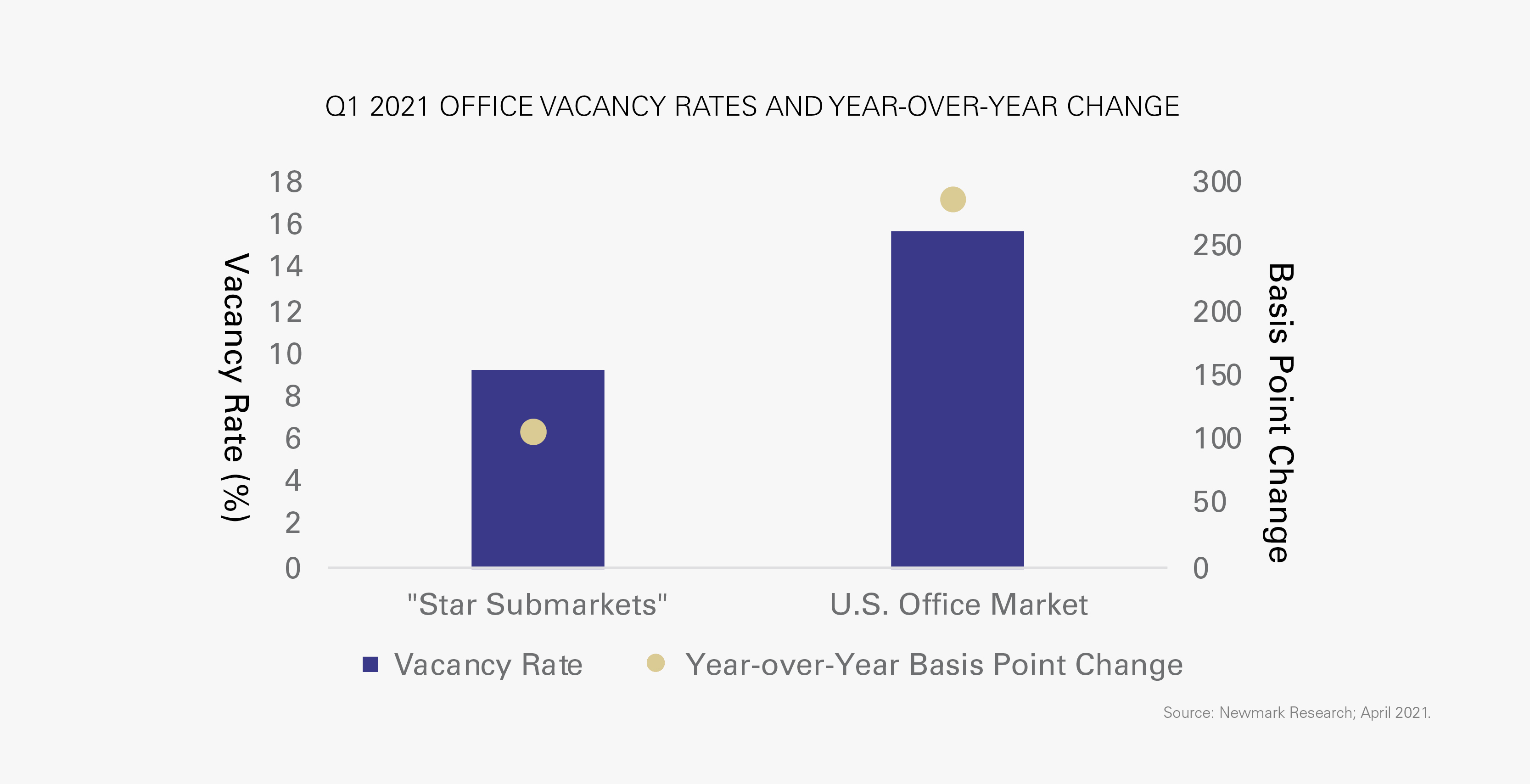

- Boasting a

long-demonstrated appeal due to their confluence of quality space, prime

location, and accessibility. Such appeal is generally reflected in

average asking rents higher than the overall market average and lower

vacancy rates. The first figure shows the 650-basis-point gap between

the lower vacancy rate of these outperforming submarkets and the higher

average rate of the broader U.S. office market.

The fight against COVID-19 shined a global spotlight on the life

sciences industry, but prior to the health crisis, the overall narrative

of a dynamic, growing industry was already catalyzing record investment

into the sector and consequently driving increased demand for

specialized commercial space. In many established and emerging life

sciences clusters around the country, life sciences leasing has not lost

momentum since the pandemic began, and in some leasing has accelerated.

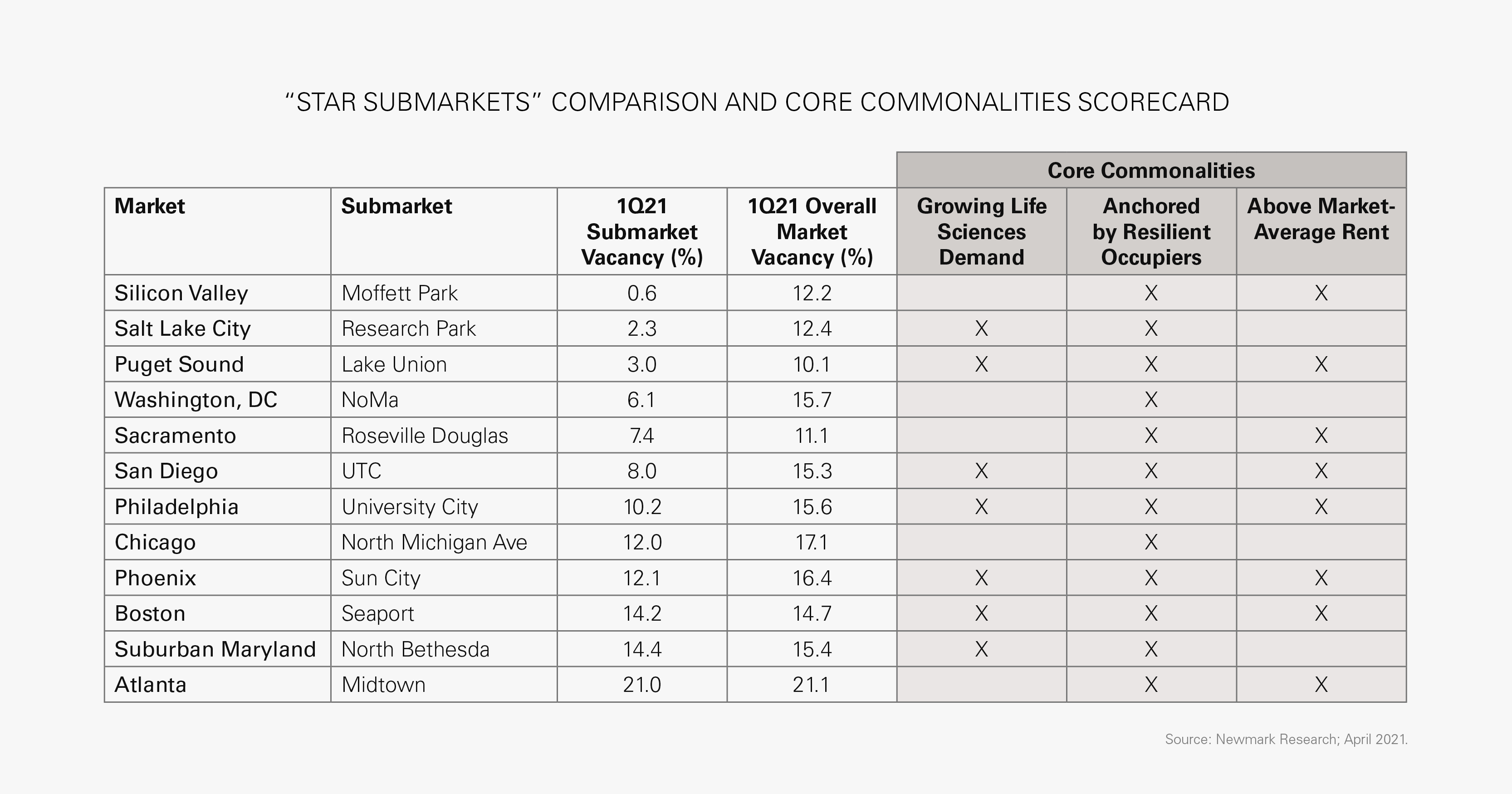

Seven of the 12 “star submarkets” shown in the second figure are

experiencing growing demand from this industry. The distinction between

submarkets with growing life sciences demand and the most mature

epicenters is also telling—Boston’s most resilient office submarket

right now is not Cambridge, its premier life sciences submarket, but

rather Seaport, where increased demand for lab space has helped

stabilize office fundamentals. Demand has increased, and vacant,

competitive office space is being removed from the inventory and

converted to lab space to accommodate tenant demand.

Portions of an office market with a vibrant concentration of

education and health institutions (“eds & meds”) or the Big Five

tech firms were also more likely to outperform surrounding submarkets.

Eds & meds have struggled with the financial toll and disruption

wreaked by the pandemic but remain among the most recession-resistant

industries. Furthermore, eds & meds institutions tend to think of a

commercial footprint in terms of a master development plan that may span

decades; compared to the uncertain life cycle of companies in more

volatile industries, an eds & meds concentration anchoring a

submarket can more reliably yield stability. Eds & meds is driving

demand in some “star submarkets” and helping to buttress others. For

example, San Diego’s UTC submarket has experienced strong demand from

healthcare due to its proximity to UC San Diego’s campus and its

associated medical and research facilities; in Chicago, the most

resilient submarket, North Michigan Avenue, is home to two of Chicago’s

main hospital groups and several Northwestern University campuses.

The tech industry has been a significant driver of weakening

fundamentals across the office landscape—a software coder does not

require a specialized built-environment in which to work—yet the largest

companies in tech, FAANG firms, have all continued to lease space

throughout the pandemic, bolstering demand in office markets across the

country. Submarkets anchored by FAANG, such as Silicon Valley’s Moffett

Park or Puget Sound’s Lake Union, have seen barely any budge in

single-digit vacancy rates during the past year. All 12 of the select

“star submarkets” reported a concentration of resilient occupiers in the

eds & meds or FAANG categories, or they are bolstered by government

occupancy. Boasting a resilient industry is perhaps the most critical

factor in a submarket outperforming during the pandemic-induced

downturn.

The final core commonality among the “star submarkets” is more

general, but exceptionally fundamental. In every market, there are the

haves and the have-nots: submarkets that are prized by tenants seeking

quality space with an amenity-rich, easily-accessible location, and

submarkets that offer more cost-conscious options, often at the expense

of these benefits. As such, desirable submarkets tend to carry with them

a higher cost of entry than the overall average market rate. There is a

fine line to this, as tenant migration away from the highest-end rent

districts has been occurring for some markets during the pandemic. Yet

across the board, higher-quality space in a prime submarket remains more

attractive to tenants than lesser-quality space. Eight of the 12 “star

submarkets” posted above-average rents in the first quarter of 2021.

Featured Submarket: Philadelphia’s University City

University City, located in Philadelphia’s Central Business District, has emerged as a “star submarket” in the past year. Already a popular office and lab destination in the Philadelphia region, it has experienced strong demand and rent growth, negligible increases in sublease availabilities, and an increase in preleased development during the past 12 months. Its world-class concentration of eds & meds has not just stabilized the submarket during this period of economic turmoil but is at the heart of the submarket’s expanding life sciences demand, especially in the cutting-edge fields of gene and cell therapy. Of the 341 identified gene therapy trials active in the U.S. in 2019, more than 280 were sponsored by hospitals, universities and the National Institutes of Health. This signals a deepening of a trend that University City has pioneered: cell and gene therapy startups spinning out of the academic and medical institutions that foster them, and taking commercial space in a growing, proximate cluster. Due to a dearth of competitive space, plus sustained and elevated demand, the average asking rent in University City grew 4.3% over the past year to $42.05/SF, which is the second-highest average asking rent in the Philadelphia market.

What Are the Implications for Our Clients?

Investment in office assets is slowly but steadily rebounding as the pandemic lessens its grip on the country. For cautious investors, taking into consideration the core commonalities of submarkets that have withstood the economic storm, and using such considerations to guide investment decisions, may mitigate risk to future asset values.

Many office occupiers located in “star submarkets,” whether those identified in this report or otherwise perennially popular office destinations in a given market, will be reassessing workplace strategy and company budgets in 2021. Those considering a reduction in office space may wish to consider the cost of underestimating space needs in the short term, only to experience a potentially higher-cost landscape when re-engaging with the market in the future.

Sources: Newmark Research, JAMA Network Open, Real Capital Analytics