November 2018

Population Data Suggests a Suburban Office Rebound

Is Coming

By Mark Russo and Daniela Stundel

The National Trend: More People Are Moving to the Suburbs. Will Corporate Offices Follow?

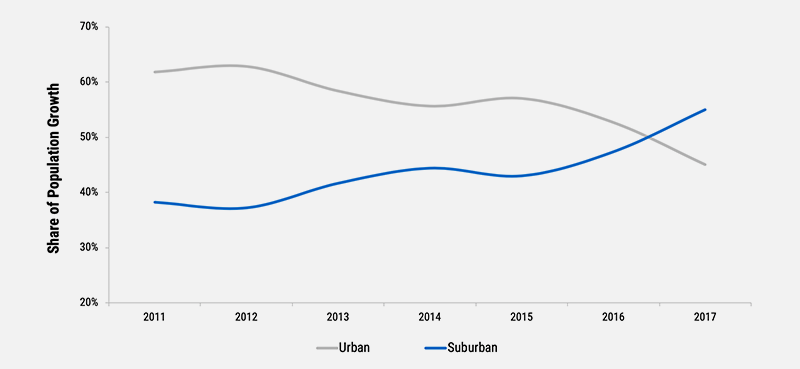

In the wake of the Great Recession, the United States experienced a period of unprecedented urban growth, pausing a trend of suburbanization that had been in place since the end of World War II. This back-to-the city movement, driven by a combination of millennial preferences and a slowly healing economy, is reflected in demographics as well as office leasing trends. According to U.S. Census data examined by Newmark for the 15 largest office markets, urban counties added 3.2 million people between 2010 and 2015 while suburban counties added only 2.2 million residents. Major corporations such as McDonald’s (Chicago), Ally (Detroit) and GE (Boston) followed suit, relocating headquarters facilities from the suburbs to downtown areas, in part to secure millennial talent for their workforces. However, the most recent demographics show a change in course as suburban jurisdictions captured 55% of the population growth last year, while urban jurisdictions captured only 45%.

SHARE OF POPULATION GROWTH IN THE 15 LARGEST U.S. OFFICE MARKETS

Urban vs. Suburban Jurisdictions2011-2017

Source: U.S. Census data compiled by Newmark for largest 15 office markets; November 2018.

U.S. suburbs maintain a higher office vacancy rate of 14.1% compared with the CBD rate of 11.4%, but suburban vacancy has declined by 210 basis points during the past five years, while CBD vacancy has declined only 140 basis points over the same period. Recent shifts in population mirror these office market metrics and may be a harbinger of future changes in office leasing trends. During 2016 and 2017, American suburbs grew nearly 50% faster than cities. The aging of the millennial generation, which correlates with child rearing, and an improving economy is likely contributing to this change in course. New single-family home sales, which are indicative of suburban growth, are up 22% over the same period. The same talent pool that once prompted many large office occupiers to move from the suburbs to the city might soon reverse that trend in a bid to work closer to their new, suburban homes. However, as older millennials gradually migrate to the suburbs, their preferences for urban amenities—especially walkable, active communities—likely will persist.

Featured Markets: Philadelphia and New Jersey

Suburbanization already may be starting to influence the office market in Philadelphia and New Jersey, and this trend is likely to accelerate. Office property owners who create a “best of both worlds” environment by offering options to work/live/play in a walkable setting stand to capitalize the most on suburban growth. One notable example is Bell Works in Holmdel, New Jersey. Somerset Development redeveloped the former Bell Labs campus in 2016 into a mixed-use community consisting of 1.2 million square feet of office space, 220,000 square feet of retail space, a 200-room hotel and 800,000 square feet of public spaces. iCIMS, which specializes in recruitment software, is Bell Works’ anchor tenant. The firm leased 350,000 square feet in 2016. Guardian Life leased 91,000 square feet at Bell Works in March 2017 and relocated its Manhattan-based information technology division there. Bell Works’ office portion was 80% leased as of the end of third-quarter 2018.

Another New Jersey-based example is the Crossings at Jefferson Park, located in the Whippany sector of Hanover, New Jersey. The former owners, a joint venture between Rubenstein Partners and Vision Real Estate Partners, purchased the complex for $25 million in 2012 and invested $10 million to reposition the three building, 550,000-square-foot complex. The improvements included the conversion of a former powerhouse structure into an 11,000-square-foot standalone amenities building with food service, tenant lounge, conference facility and fitness center. Barclays, an existing tenant, purchased the complex for $69 million in June 2017 with the intention of relocating 900 back office jobs to New Jersey from Manhattan.

In 2017, Equus Capital Partners renovated the Bay Colony Executive Park, located in Wayne, Pennsylvania. A Southeastern Pennsylvania Transit Authority (SEPTA) bus route serves the four building, 247,294-square-foot office development. The executive park includes dining and conference facilities. In addition, the outdoor area was landscaped and connected to the cafe. The business park is within one mile of the King of Prussia Town Center—a newly built lifestyle community consisting of shopping, dining and residential developments. The current vacancy rate at Bay Colony is just 5.0%, reflecting the importance to office tenants of having nearby restaurants and retail.What Are the Implications for Our Clients?

If the nation’s population continues to disperse outside of city centers as millennials start families—consistent with the patterns of prior generations—suburban office locations likely will become more desirable. A critical consideration over the long term is whether these locations prove helpful in terms of employee recruitment and retention. Corporate occupiers should keep this in mind and consider locations that offer urban amenities in a suburban setting—a blend of the active environment and convenience that today’s workers, including millennials, prize. Investors have the opportunity to acquire undervalued suburban product and to add lifestyle amenities to stranded assets, both of which may allow them to take fuller advantage of the next wave of suburbanization.