The Scottish Government has published its 2026/27 Budget confirming important changes to non-domestic rates that will affect businesses across Scotland. Below is a summary of the headline measures, including the new multipliers for the 2026/7 rate year, relief schemes, and transitional arrangements designed to ease the impact on rate demands following on from the Revaluation.

The Budget at a glance

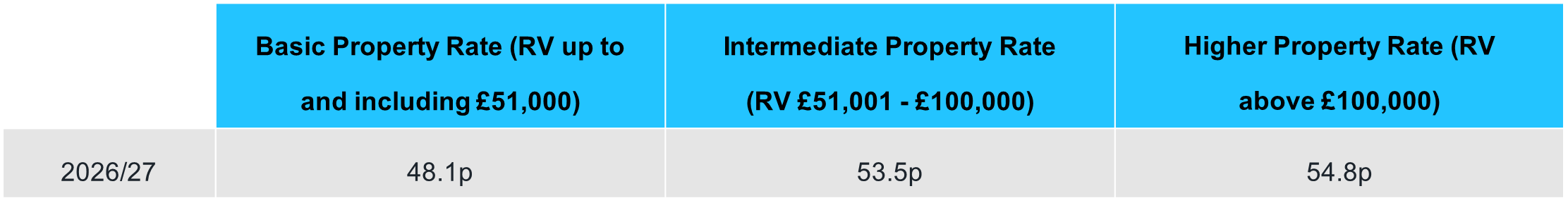

Multipliers to reduce from 2025/26 levels across all tiers:

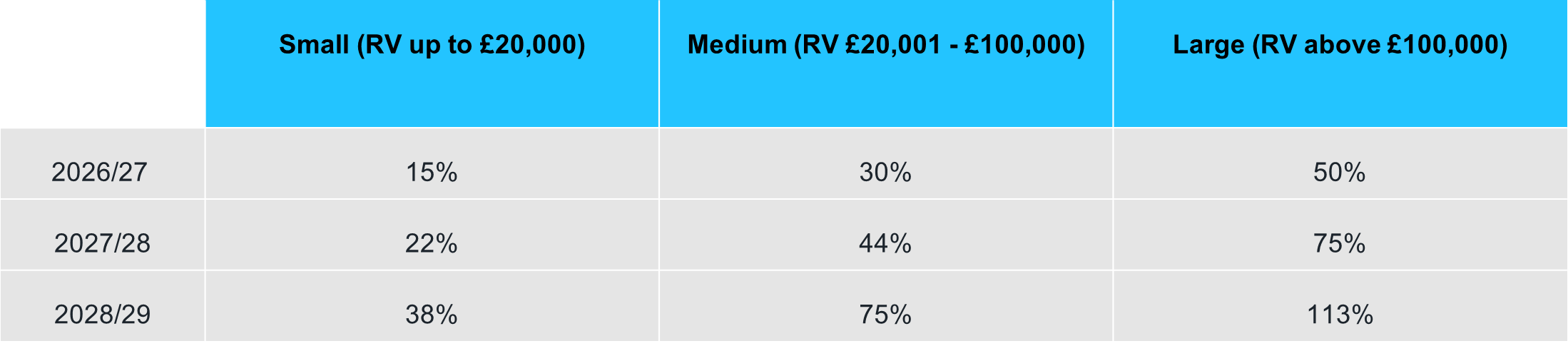

Transitional Relief: The Government has announced a scheme to phase in bill increases following the 2026 revaluation.

Note that all of these measures are subject to Scottish Parliament approval and detailed secondary legislation, which will set precise eligibility, poundage levels, and administrative processes.

- Retail, Hospitality and Leisure (RHL) relief: The Scottish Government has introduced a new relief of 15% to be applied from 2026/27 throughout the 2026/29 revaluation cycle for qualifying properties liable at the basic or intermediate poundage. This will be capped at £110,000 per business per year and subject to subsidy control measures. In islands and remote areas, the relief will continue at 100%.

- Small Business Bonus Scheme (SBBS) to continue at existing thresholds: around 100,000 properties will continue to pay no rates for the next three years.

- A new 100% Relief for eligible Electric Vehicle charging points for 10 years from 1 April 2026.

What this means for you

- Most small occupiers remain protected as SBBS continues to keep many small units at a zero bill for the period.

- The new 15% RHL relief, alongside lower 2026/27 multipliers, will temper increases for many eligible shops, restaurants, bars and leisure assets; however, where RVs have risen materially, most will still see a net increase unless the Small RV transitional cap applies.

- Properties with materially higher RVs in 2026 will have increases phased via Transitional Relief.

How Scottish non-domestic rates work

- Rateable Value (RV) is set by the Scottish Assessors Association (SAA). Your annual bill is broadly RV × multiplier, less any reliefs, plus/minus supplements.

- Scotland operates three poundage tiers: Basic, Intermediate, and Higher, linked to RV bands. The Budget indicates reductions across all three for 2026/27 as outlined above.

- Revaluations now occur every three years. The next cycle runs 1 April 2026 to 31 March 2029.

How we can help

We’re available to talk through how these measures may affect your properties and budgeting, and to point you to the most relevant reliefs and next steps, including challenges to your rateable value.

If you have not already reached out to the team please contact us as soon as possible. As a reminder, there is a strict four-month window from 1 April 2026 to make formal challenges against rateable values. Failing to do so restricts your ability to challenge values and liabilities until 2029.

We will continue to keep you updated on any further changes as we approach April 2026.