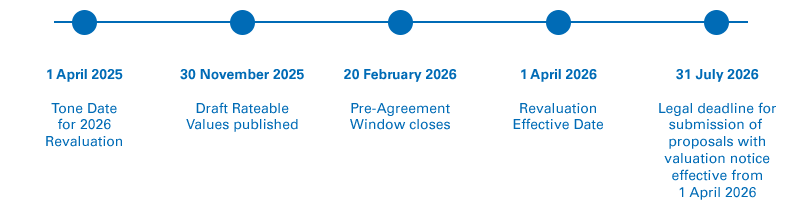

Commercial property owners and tenants in Scotland need to prepare for the 2026 Revaluation Tone Date on 1 April 2025 and the 2026 Revaluation itself, which will commence in just over a year. Understanding the ‘Tone Date’ is crucial for businesses as it forms the foundation for property valuations and subsequent business rate calculations. Our updates aim to provide an essential baseline for understanding the evolving market and how to respond.

What is the ‘Tone Date’?

The Rateable Value (RV) of a non-domestic property is based on an assessment of the open market rental value of the property at a specific date, namely the statutory ‘Tone Date (also referred to as the Antecedent Valuation Date or AVD). To determine business rates for the 2026 Revaluation in Scotland, the Scottish Assessors will use the Tone Date of 1 April 2025 to assess the value of all non-domestic properties resulting in new RVs. The new RVs will take effect 1 April 2026 and govern business rates payments for the following three years.

To establish accurate Rateable Values, the Assessors collect rental information, construction costs and, for some types of property, accounts or turnover information. The Assessors then analyse the information to establish the level of value for each property class in each locality.

The analysed figure is not the actual rent of the property but the hypothetical rental value for the property class in an area. It is essential to know that the level of value is determined locally, although the approach to valuation will be broadly the same across Scotland.

Why is it relevant?

The Barclay Review recommended a three-yearly revaluation cycle in Scotland, with a tone date one year before revaluation. This diverges from England’s two-year lead time. Scotland’s approach aims to ensure that the Rateable Values more accurately reflect market values during the revaluation.

A one-year tone date aims to provide a business rates system that reflects the fluctuations in the commercial property market. Over the past year, the economy and the property market have responded to the impacts of global events and periods of inflation; this should be reflected in the figures for the next revaluation.

Assessor Information Notices

The Scottish Assessors are now issuing Assessors Information Notices (AINs) to obtain information in preparation for the 2026 Revaluation which is based on a Tone Date of 1 April 2025. It is therefore imperative that any notice received is directed to the appropriate person within your organisation and acted on within the statutory time limit. These information requests, with their stringent 28-day window, can be onerous. This is more than just an administrative task; failure to return the form within 28 days will result in a civil penalty being issued to your business.

A reminder of the penalties for failure to return information when requested:

- Stage 1 Penalty – non return within 28 days from issued AIN could result in a fine of the greater of £200 or 1% of the Rateable Value of the property at the time (or £1,000 where the Lands and Heritages are not currently entered in the Valuation Roll)

- Stage 2 Penalty – non return within a further 42 days from original penalty notice could result in fine of the greater of £1,000 or 20% of the Rateable Value of the property at the time (or £10,000 where the Lands and Heritages are not currently entered in the Valuation Roll)

- Stage 3 Penalty – no return after period of a further 56 days from original penalty notice could result in a fine of the greater of £1,000 or 50% of the Rateable Value (or £50,000 where the Lands and Heritages are not currently entered in the Valuation Roll)

The penalties are cumulative and where no response is provided a fine of up to 71% of the rateable value could be issued. Any penalty notice issued by an Assessor can be appealed, however there are strict grounds for an appeal at the First Tier Tribunal which would be determined by a committee.

Newmark can assist you with completing and returning the notices. By proactively managing your information gathering and submission process, we can provide this vital service while protecting your financial stability beyond mere compliance.

Role of pre-agreements

In some cases, there is an opportunity to ‘pre-agree’ your Rateable Values ahead of the 2026 Revaluation. The benefit of a pre-agreement is that it fixes your Rateable Values over a three-year period, assists you with budgeting and provides you with financial certainty over that period.

We would recommend early engagement with our experts to ensure that a pre-agreement can be reached.

Contact us

As ever, if there are any queries relating to your non-domestic rates, please do not hesitate to contact us.