The National Trend: Robust Demand for Lab Space is Sparking Conversions

Since the start of the COVID-19 outbreak in the U.S., the nation’s commercial real estate markets have faced countless headwinds. Widespread work-from-home participation and public health-related shutdowns adversely affected certain sectors, including retail, hospitality and office. Others, like logistics and warehousing, have outperformed despite challenging overall economic conditions. The life science sector has also posted some of the strongest fundamentals in its history as the pandemic accelerated change within the industry.

Demand for lab space intensified throughout the past year, particularly in premier biomedical research hubs like Boston/Cambridge, the San Francisco Bay Area and San Diego, as continued strength in government funding, venture capital and the public markets has driven biotechnology company expansions all along the growth spectrum. With first-quarter U.S. venture capital investments soaring to historic heights, life science companies raised a record $12.2 billion during the first three months of 2021 according to data from Pitchbook. Such strong capital flows are bolstering novel scientific research and therapeutic targets, which provide a solid base of tenant demand for commercial real estate. This outsized demand, coupled with office fundamentals that are still facing downward pressure in many markets, are compelling asset owners to convert portions (or the entirety) of traditional office buildings for lab use.

It’s no surprise that Boston/Cambridge, the San Francisco Bay Area and San Diego are also leading the way in the repositioning of office properties. These markets boast natural supply constraints, dynamic high-tech industries and robust economies, and they are key hubs for biotechnology research and development. However, growing life science markets including Seattle, Philadelphia, New York City and Chicago are also experiencing increased activity. The 7.8 million square feet of current and planned office-to-lab conversions throughout Greater Boston represents nearly 30% of the metro’s current lab inventory while New York City’s 2.0 million square feet in conversion projects would almost double that market’s lab stock. Comparatively, conversions in some emerging markets equate to 10-16% of current lab inventories. While purpose-built lab space has also gained traction in many metros, office-to-lab conversions represent greater than 20% of total lab space under construction or renovation in six out of the 11 largest U.S. life science markets. As the number of asset owners exploring potential lab conversions continues to grow, speed to market remains vital, and experienced life science developers that move quickly will benefit the most.

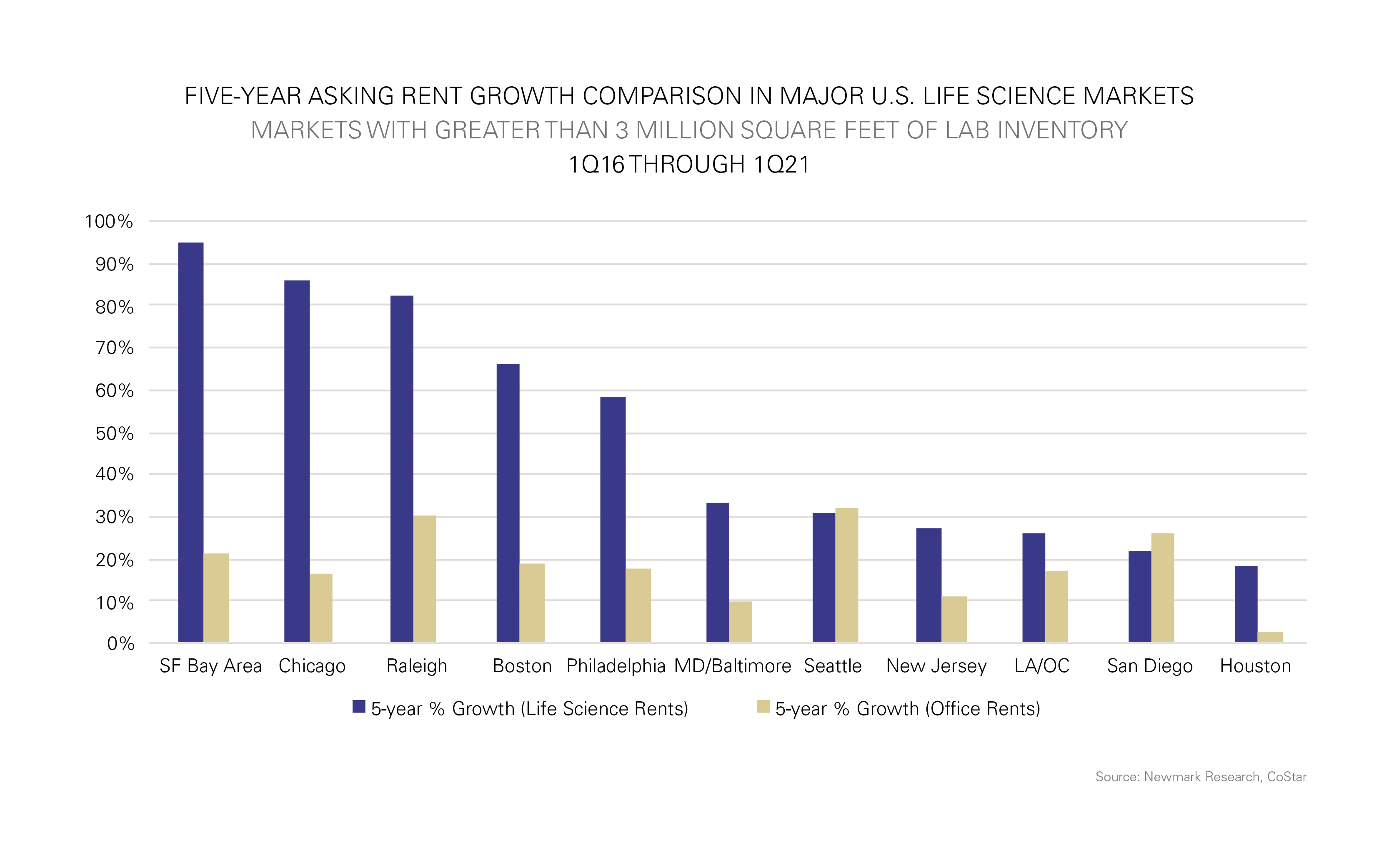

Attractive returns, driven largely by outsized rent growth, have also made lab space extremely appealing to asset owners and investors. The adjacent figure highlights cumulative growth in asking rents over the past five years across major life science markets in the U.S. Asking rents for lab space in the San Francisco Bay Area, Chicago, Raleigh and Boston have increased by more than 60% since the first quarter of 2016 while office rents increased by only 15–30% during the same period. Similar trends can be found in Philadelphia, New Jersey and Los Angeles. New construction—both conversions and ground-up developments—are garnering even higher pricing as strong pre-leasing and tenant interest are putting further upward pressure on rates. Rent premiums on new space in mature life science markets are 20-40% above current average asking rents.

Featured Market: San Diego

San Diego’s life science industry has grown rapidly in recent years, elevating the prominence of the region and attracting new firms, venture capital and top-tier talent to the market. Among other factors, San Diego’s concentration of universities and institutional research facilities has been a magnet for biotechnology and pharmaceutical firms at all stages of growth.

The San Diego metropolitan area has benefitted tremendously from the economic impact of its life science industry; however, the speed of the industry’s growth has forced real estate markets to be creative in meeting the demands of this expansion. Much of the demand for biotechnology and lab-supportive space has been clustered in the Sorrento Mesa area and near the University of California San Diego campus. Both areas are inventory and development constrained, which is supporting office-to-lab conversion activity totaling 709,427 square feet as of the end of first-quarter 2021. This large pipeline of active conversion projects is the fourth largest among U.S. metros and measures 48.2% of the metro area’s total lab space under construction and 3.9% of overall life science inventory.

Speed to market and land constraints are likely to remain significant drivers in San Diego’s office-to-lab conversion market. However, as the industry grows regionally, developers may consider breaking from the traditional life science cluster and begin establishing lab-supportive facilities elsewhere in the region. The most notable planned biotechnology development outside of San Diego’s traditional life science core is The Research and Development District (RaDD), from IQHQ, Inc. This planned 1.6 million-square-foot office and lab development will establish a major life science cluster on the waterfront near downtown San Diego.

What Are the Implications for Our Clients?

The recent growth of the life science industry has presented real estate owners and investors with an opportunity to capitalize on a rapidly expanding sector with specific needs. Office markets have been challenged since the onset of the pandemic and some asset owners in high-demand life science markets may see financial benefits in repositioning office assets into commercial laboratory facilities. While the cost of conversion is substantial and land use/zoning challenges could prove problematic in some jurisdictions, demand for high-quality lab space is solidly outstripping existing supply. Investors may wish to partner with an industry expert, given the specific nature of the space required by modern life science occupiers. Still, office-to-lab conversions could be an opportunity for asset owners to reposition aging properties, particularly in high-demand markets such as Boston/Cambridge, Philadelphia, and San Diego.

Users of lab space will continue to experience tight market conditions in the coming quarters and steady asking rent growth is likely. In some markets, new office-to-lab conversions or new-build facilities may begin to develop outside of the traditional life science clusters. This may present creative opportunities for occupiers who are willing to move to pioneering locations.

Sources: Newmark Research, CoStar, Pitchbook